Adios to steering wheels

.png)

A Glimpse into the Future

It’s 2030, and Sarah steps out of her apartment in downtown San Francisco. She taps her phone, and within minutes, a sleek, driverless vehicle glides to a stop in front of her. No driver, no steering wheel—just a quiet hum and a glowing interface welcoming her aboard. The car, a Waymo robotaxi, navigates the bustling city streets with precision, dodging pedestrians and merging seamlessly into traffic. Meanwhile, across the country, a fleet of Tesla Cybercabs shuttles passengers in Austin, their vision-based systems humming through complex intersections. This isn’t science fiction—it’s the future of autonomous driving, a revolution reshaping how we move, work, and live.

What Are Autonomous Vehicles?

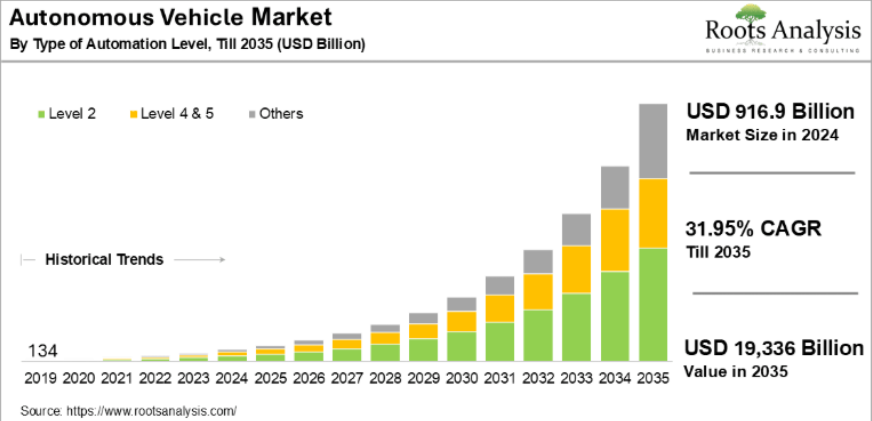

Autonomous vehicles (AVs) are cars, trucks, or other vehicles capable of navigating without human intervention, using a combination of sensors, artificial intelligence (AI), and advanced computing. The Society of Automotive Engineers (SAE) defines six levels of automation, from Level 0 (no automation) to Level 5 (full automation, no human input required). Today’s market includes Level 1 and 2 systems, like Tesla’s Autopilot, which offer partial automation, while Level 3 (conditional automation) and Level 4 (high automation in specific conditions) are emerging in premium vehicles and robotaxi services. Level 5, where vehicles operate autonomously in all conditions, remains a long-term goal. This spectrum of technologies underpins the projected growth of the AV market, expected to soar from USD 0.9 trillion in 2024 to USD 19.3 trillion by 2035, according to Roots Analysis.

Key Drivers of Market Growth

Several factors are propelling the rapid expansion of the autonomous driving market:

1. Enhanced Safety Standards

Human error accounts for over 90% of the 1.3 million annual road fatalities globally. Autonomous vehicles, equipped with advanced driver-assistance systems (ADAS) such as collision avoidance and automated braking, aim to significantly reduce these incidents. Regulatory bodies in regions like the EU and China are implementing stringent safety mandates, accelerating the adoption of AV technologies.

2. Technological Advancements

Innovations in artificial intelligence (AI), machine learning, and sensor technologies—including LiDAR, radar, and high-resolution cameras—are driving AV development. LiDAR costs have decreased by over 60% since 2020, enabling broader deployment of Level 3 (conditional automation) systems. Additionally, 5G connectivity and vehicle-to-everything (V2X) communication enhance real-time data exchange, improving system reliability and performance.

3. Rising Consumer and Commercial Demand

Consumers are increasingly receptive to autonomous vehicles due to their potential to enhance convenience and productivity. In urban centres, where traffic congestion is prevalent, AVs offer a compelling value proposition. Concurrently, commercial applications such as robotaxis and autonomous delivery are gaining traction, driven by the need for cost-efficient logistics solutions. The logistics segment is projected to grow at a 14% CAGR, reflecting strong demand for last-mile delivery optimization.

4. Supportive Regulatory and Infrastructure Developments

Governments worldwide are fostering AV adoption through supportive policies and investments in smart infrastructure. China’s smart transportation initiatives and the EU’s Green Deal are notable examples. Dedicated testing zones, such as Beijing’s Autonomous Driving Zone and the UK’s connected vehicle testbeds, are facilitating real-world deployment and refinement of AV technologies.

5. Synergy with Electric Vehicles

The majority of AVs are electric, aligning with global sustainability objectives. Electric vehicles (EVs) provide an ideal platform for autonomous systems due to their integrated electronic architectures. Incentives such as tax credits and subsidies further bolster the growth of electric AVs, which held a 45% market share in 2024.

Current Market Landscape

The autonomous driving market is advancing steadily, with significant progress across various automation levels:

- Level 1 and 2 Systems: These systems, encompassing basic and partial automation (e.g., adaptive cruise control and Tesla’s Autopilot), accounted for over 55% of the market in 2024. Their affordability and scalability drive widespread adoption.

- Level 3 Systems: Conditional automation, where vehicles can operate autonomously under specific conditions, is gaining momentum in premium vehicles such as the BMW 7-Series. Cost reductions and increasing consumer confidence are expected to accelerate growth.

- Level 4 and 5 Systems: Level 4 (high automation) is operational in limited contexts, such as Waymo’s robotaxi services in San Francisco/Phoenix and other U.S. cities. Level 5 (full automation) remains a long-term goal, with commercial deployment projected for 2030.

- Regional Dynamics: North America leads with a 25–40% market share, driven by innovation hubs and permissive regulations in states like California. The Asia-Pacific region, particularly China, is the fastest-growing market, with a projected CAGR of 35–36.9%. Europe is also a key player, with significant investments in Germany, the UK, and France (source: Root Analysis).

- Applications: The transportation sector, including ride-hailing and logistics, dominates with an 85–93% market share. Emerging applications in defence, such as autonomous military vehicles, are gaining attention.

The industry supports over 567,000 jobs globally, with 52,000 added in 2024, and has generated over 37,000 patents, underscoring its innovation intensity (source: Root Analysis).

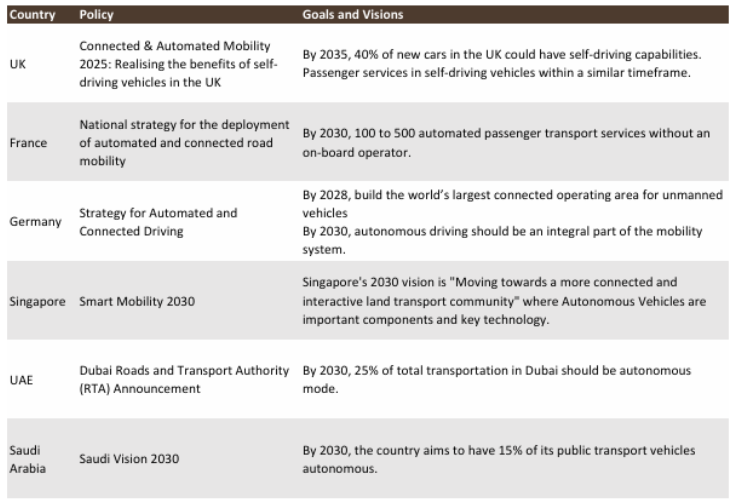

Policies and Regulations: Rules of the Road

The rules for AVs are a big deal—they decide how fast the market can grow while keeping safety, data privacy, and public trust in check. As of 2025, different parts of the world have their own approaches, with China going all-in, the U.S. mixing federal and state efforts, and the EU aiming for consistent rules. Here’s a breakdown by region, bundled for clarity, with a timeline of key policies:

United States

The National Highway Traffic Safety Administration (NHTSA) establishes critical guidelines and regulations for autonomous vehicle (AV) development and deployment. The "Automated Vehicles 4.0" framework (2020) provides a foundation for AV safety standards. In 2022, NHTSA issued regulations permitting companies to develop and deploy AVs without traditional manual controls, such as steering wheels or pedals, provided they comply with stringent federal safety requirements. These vehicles remain in the testing phase, with expectations for full deployment within the next two years, potentially sooner, based on ongoing advancements. In 2025, NHTSA is finalizing data-sharing regulations proposed in 2023 to enhance AV safety monitoring and clarify liability in incidents.

- Timeline

- 2020: NHTSA releases "Automated Vehicles 4.0" guidelines, outlining AV development and safety protocols.

- 2022: NHTSA authorizes AVs without manual controls to meet federal safety standards.

- 2023: NHTSA proposes mandatory data-sharing regulations to track AV safety and liability.

- 2025: NHTSA anticipates finalizing data-sharing regulations; new legislation is under consideration to enable cross-state autonomous truck operations.

European Union

The EU wants consistent rules across its countries to make AVs work smoothly across borders. The 2019/2144 Regulation (effective 2022) sets standards for approving automated vehicles, and the Vehicle General Safety Regulation requires features like intelligent speed assistance in new cars.

- Timeline:

- 2019: EU introduces Regulation 2019/2144 for automated vehicle approvals, effective 2022.

- 2021: Germany legalizes Level 4 autonomous driving.

- 2022: EU’s 2019/2144 Regulation takes effect; Vehicle General Safety Regulation mandates safety features.

- 2025: Germany and France require black-box recorders for AVs; Switzerland permits driverless robotaxis (March); EU proposes less strict rules and plans unified framework by 2026.

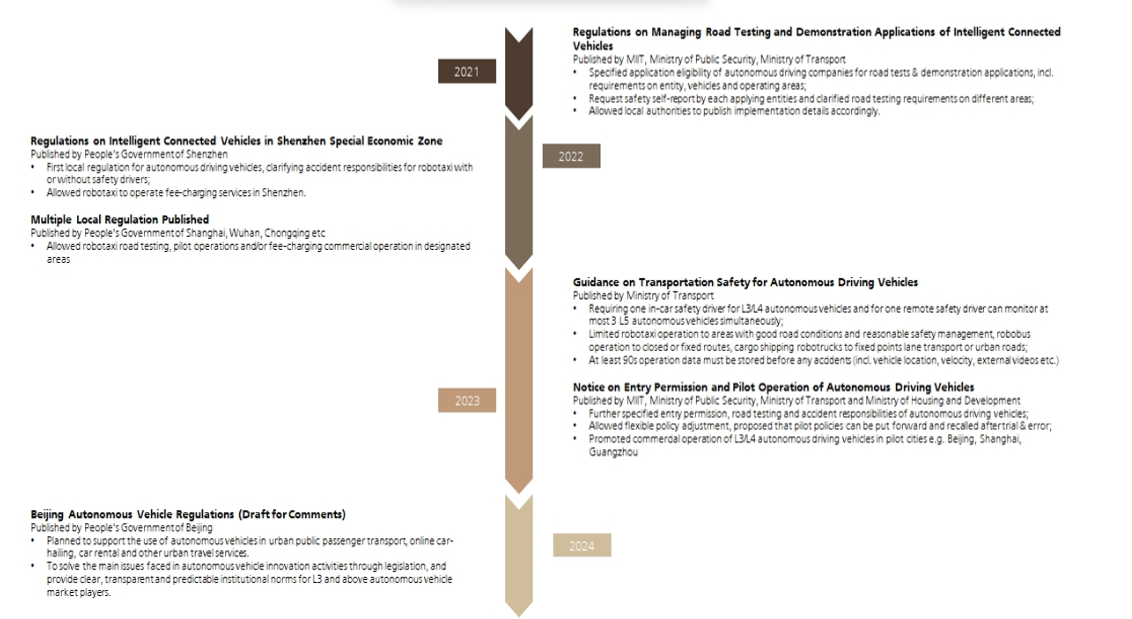

China

China sees AVs as a key part of its “Made in China 2035” plan, aiming for Level 4 vehicles in stores by 2025. Rules focus on testing in controlled zones first, with a human overseer required. In April 2025, the Ministry of Industry and Information Technology (MIIT) tightened rules, banning public beta testing without approval and requiring driver monitoring systems that can’t be turned off. July 2025 brought ethical guidelines pushing safety and data protection. Data security laws from 2021–2022 control how car data is handled. At least 30% of new vehicles in 2025 must have Level 3+ autonomy, and over 20 cities allow city-wide testing, helping companies like Baidu run 24/7 driverless services.

- Timeline:

- 2021–2022: Data security laws introduced for automotive data handling.

- 2025: China targets 30% of new vehicles with Level 3+ autonomy; MIIT bans unapproved public beta testing (April); ethical guidelines issued (July) for safety and data protection.

Key Industry Players

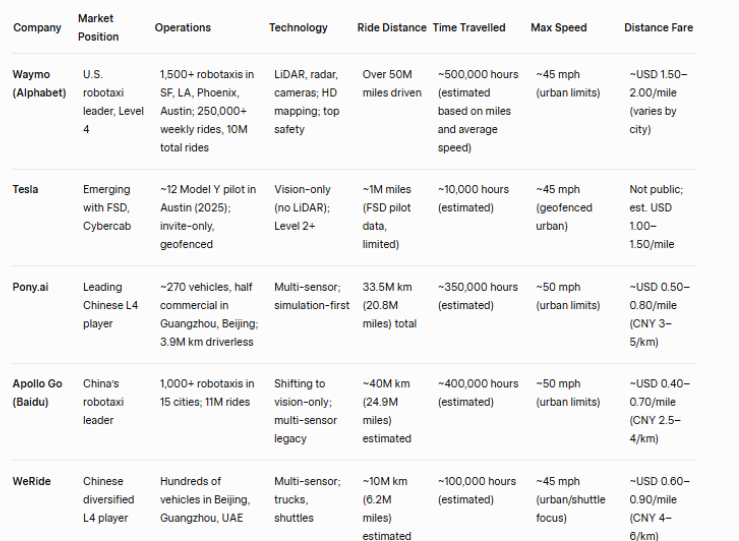

The autonomous driving market features a diverse ecosystem of established automakers, technology firms, and innovative startups:

- Tesla: A leader in vision-based AI, Tesla’s Full Self-Driving (FSD) software and upcoming Cybercab robotaxi aim to disrupt the market with cost-competitive solutions.

- Waymo (Google): A pioneer in autonomous driving, Waymo operates robotaxi services in multiple U.S. cities, leveraging LiDAR, Google Map and Alphabet’s AI capabilities.

- Cruise (General Motors): Focused on urban mobility, Cruise is expanding its robotaxi operations in San Francisco and other cities.

- Baidu Apollo: A dominant force in China, Baidu’s Apollo platform powers robotaxis in cities like Wuhan, benefiting from strong government support.

- European Automakers (Volkswagen, BMW, Mercedes-Benz): These companies are advancing ADAS and Level 3 systems, with Volkswagen targeting autonomous ride-hailing by 2026.

- Technology Providers (NVIDIA, Intel, Qualcomm): These firms supply critical AI chips and software, with NVIDIA’s DRIVE platform leading the market.

- Startups (Pony.ai, Weride, Zoox): Chinese startups and Amazon’s Zoox are scaling innovative solutions, from robotaxis to purpose-built autonomous pods.

Competitive Analysis: Waymo vs. Tesla

The competition between Waymo and Tesla represents a pivotal dynamic in the AV market, with each pursuing distinct strategies. While some may perceive Tesla’s Full Self-Driving (FSD) system as Level 4, it currently operates at Level 2, requiring human supervision. Tesla is actively working to achieve Level 4 autonomy with its Cybercab robotaxi, targeting delivery by 2026–2027.

Waymo: Precision and Proven Deployment

Waymo, a subsidiary of Alphabet, has established itself as a leader through its operational robotaxi services in Phoenix, San Francisco, Los Angeles, and Austin. Its approach combines LiDAR, radar, and cameras with extensive testing and mapping.

- Strengths:

- Robust Safety Record: Waymo’s multi-sensor approach and millions of miles driven ensure high reliability and safety.

- Operational Success: Its Waymo One service has served thousands of riders, demonstrating commercial viability.

- Strategic Partnerships: Collaborations with Stellantis and Uber enhance scalability and market reach.

- Challenges:

- High Costs: LiDAR and other sensors increase production costs, potentially limiting mass-market adoption.

- Geographic Constraints: Waymo’s reliance on pre-mapped environments restricts its scalability.

- Conservative Expansion: A cautious approach may cede ground to faster-moving competitors.

Tesla: Innovation and Scalability

Tesla’s strategy centres on its vision-based Full Self-Driving (FSD) system, powered by proprietary AI and neural networks. Its Cybercab robotaxi, unveiled in October 2024, targets affordability and mass production by 2026–2027.

- Strengths:

- Cost Efficiency: Eliminating LiDAR reduces costs, with the Cybercab priced below USD 30,000.

- Data Advantage: Tesla’s extensive vehicle fleet provides vast real-world data, enhancing AI performance.

- Integrated Ecosystem: In-house development of chips, software, and vehicles ensures agility.

- Challenges:

- Safety Scrutiny: Tesla’s vision-only system has faced criticism following incidents, and its FSD remains at Level 2+.

- Regulatory Risks: Ambitious timelines may conflict with regulatory requirements.

- Execution Uncertainty: A history of delayed milestones raises questions about Tesla’s delivery capabilities.

Strategic Implications

Waymo’s proven deployments and safety focus position it as the current leader in operational AV services, particularly in the robotaxi segment. Tesla, however, has the potential to disrupt the market with its cost-effective, scalable approach, provided it overcomes technical and regulatory hurdles. The outcome will hinge on regulatory developments, technological reliability, and consumer acceptance.

Potential Risks and Challenges

Despite its promise, the autonomous driving market faces several risks that stakeholders must address:

1. Regulatory Complexity

Divergent regulations across regions—such as the 29 U.S. states with distinct AV policies—create compliance challenges. For instance, California’s 2023 veto of autonomous trucking legislation highlighted labour-related resistance, which could delay commercial deployments.

2. Consumer Trust

Public scepticism persists due to high-profile incidents involving robotaxis and ADAS systems. Transparent safety reporting and consistent performance are critical to building confidence.

3. Financial Barriers

AV development requires substantial investment, with estimates exceeding USD 4–5 billion for full-journey autonomous trucks and robotaxis. Infrastructure costs, such as 5G networks, further strain budgets, potentially limiting adoption in cost-sensitive markets.

4. Cybersecurity Vulnerabilities

As connected systems, AVs are susceptible to cyberattacks that could disrupt operations or compromise safety. Robust cybersecurity measures are essential to mitigate these risks.

5. Technical Limitations

Adverse weather, complex urban environments, and edge-case scenarios continue to challenge AV systems. Achieving Level 5 autonomy remains a long-term objective, requiring significant innovation.

6. Socioeconomic Impacts

Widespread AV adoption could disrupt employment in driving-related industries, prompting resistance from labour groups and affecting economies dependent on these jobs.

Recent Developments

Recent milestones underscore the market’s momentum:

- Waymo Expansion: Waymo scaled its robotaxi services to Los Angeles and Austin, with plans for Atlanta in 2025.

- Tesla’s Cybercab: Unveiled in October 2024, Tesla’s Cybercab and Robovan are set for testing in 2025, with production targeted for 2026–2027.

- Baidu’s Progress: Baidu’s Apollo platform has achieved cost-competitive robotaxi services in China’s major cities.

- Cruise Recovery: Cruise resumed testing in San Francisco following a 2023 setback, focusing on urban mobility.

- Regulatory Advances: California approved expanded robotaxi operations in 2023, and the EU’s cross-border testbeds are facilitating Level 4 development.

Strategic Outlook

The autonomous driving market is at a turning point, with huge potential but some hurdles to clear. By 2030, Level 4 systems should be common in cities and logistics, with Level 5 still a decade away. North America, Asia-Pacific, and Europe will lead, with China likely taking the crown down the road given government policy support and strong infrastructure and Tesla likely being the winner in globalisation of autonomous driving given its cost competitiveness and scalability (if able to achieve Level 4 sooner than expected).

The ultimate winner in the autonomous driving market will excel in delivering reliable, affordable Level 4 technology, scaling operations globally, navigating regulations, and building consumer trust through safety and competitive pricing.